If you’re running a business in Dubai, accounting is no longer just about balancing books – it’s about staying compliant, making smart decisions, and avoiding costly penalties.

With VAT, corporate tax, and mandatory audits now part of the UAE’s business reality, the pressure is on to get your numbers right. From monthly bookkeeping to annual financial audits, businesses here need more than a basic system. They need accuracy, timeliness, and a solid understanding of local regulations.

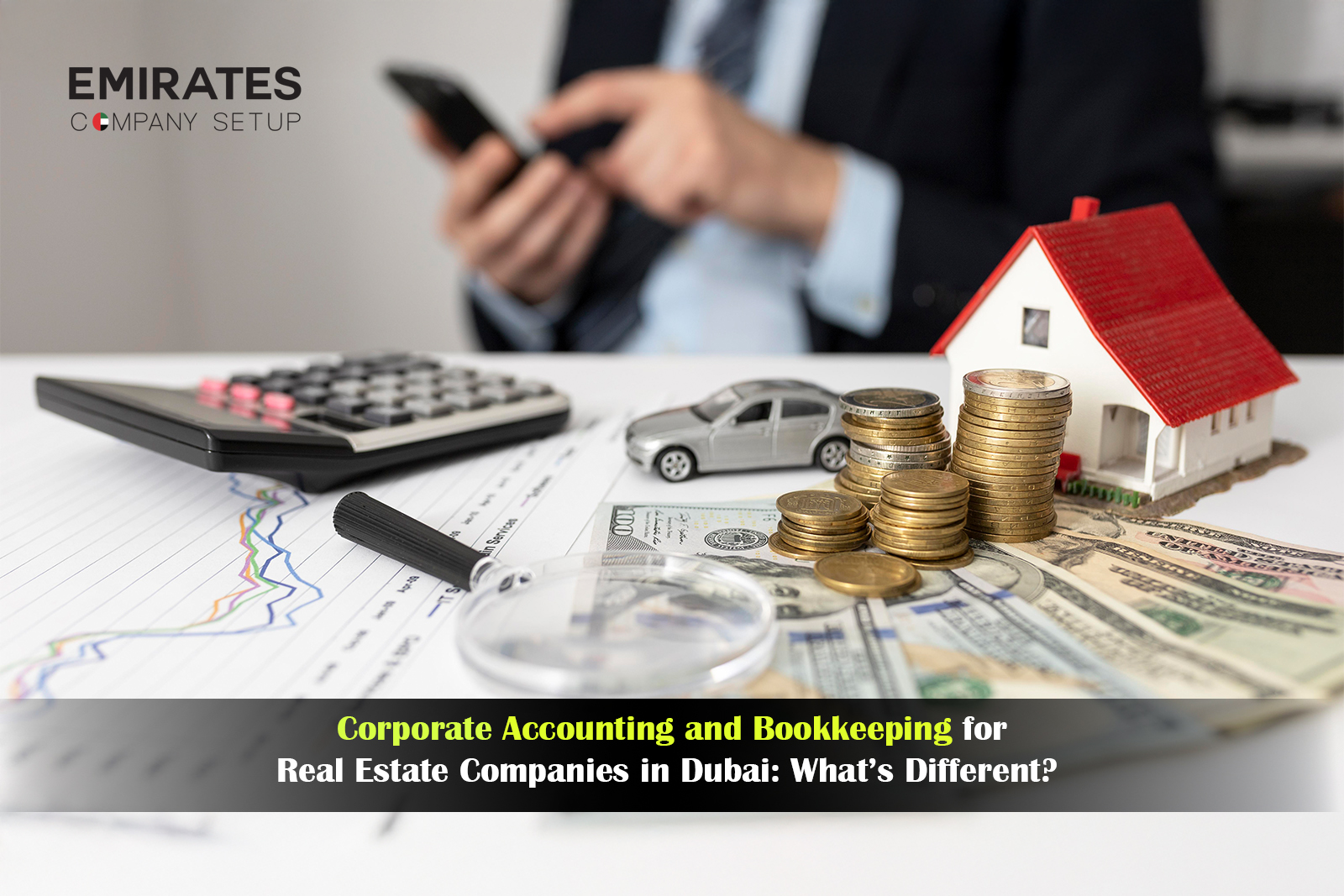

That’s where the in-house vs. outsourced accounting debate kicks in.

Should you build a team internally or work with professional accounting firms in Dubai? Each option comes with trade-offs in cost, control, and compliance. Let’s break down both routes so you can decide what makes the most sense for your business.

What In-House Accounting Looks Like in Dubai

Hiring an in-house accounting team in Dubai means building and managing your own finance department. This typically includes accountants, tax specialists, and sometimes CFO-level oversight—especially for growing companies.

Here’s what it usually involves:

- Dedicated internal team structure: You hire full-time employees responsible for everything from bookkeeping to budgeting and compliance. This team works closely with other departments, ensuring financial decisions align with internal goals.

- Use of licensed accounting software: Most in-house teams in Dubai rely on software like Zoho Books, Tally, or QuickBooks to manage their accounting. These tools are tailored to the UAE’s VAT and corporate tax requirements, making compliance a bit easier—if set up correctly.

- Total cost goes beyond salaries: You’re not just paying monthly wages. You’re also covering benefits, office space, HR management, and continuous training to keep up with the UAE’s ever-evolving regulations. The cost of in-house accounting can add up quickly, especially for SMEs.

- More control and collaboration: Your team is always available, sits in the same office, and understands the company’s context. This gives you real-time access to financial data and easier coordination with decision-makers.

- But scaling comes with friction: As your business grows, the demands on the accounting team multiply. You may need to hire more people, upgrade systems, or retrain staff. And hiring qualified accountants in Dubai isn’t always easy, especially if you’re looking for experience in corporate tax compliance or audit prep.

- Challenges in talent retention: Dubai’s finance sector is competitive. Skilled professionals are in high demand, which can make it hard to retain experienced team members long-term, especially for smaller companies.

What Outsourced Accounting Means for Dubai Businesses

Outsourcing accounting means partnering with an external firm that manages your financial records, ensures tax compliance, and prepares for audits—all without having to build a full in-house team.

Here’s what you can expect:

- A wide scope of services: Reputed accounting firms in Dubai offer everything from professional bookkeeping services and VAT return filing to audit preparation and even CFO-level strategy sessions. This is ideal if you need end-to-end support without needing to micromanage it all.

- Flexible pricing models: You can choose between monthly retainers or pay-as-you-go options depending on the level of service. For many SMEs, this makes outsourcing accounting services in Dubai a far more affordable choice than hiring internally.

- Built-in compliance and accuracy: These firms are already aligned with the UAE’s financial reporting rules, including corporate tax, VAT, and AML compliance. That means fewer mistakes, lower risk of fines, and better peace of mind.

- Access to experienced professionals: You get to work with experts who handle finance for companies across industries. That experience translates into sharper insights and quicker solutions, without the cost of full-time hires.

- Some loss of day-to-day visibility: Unlike in-house staff, outsourced teams aren’t sitting in your office. You may need to plan for communication delays or occasional back-and-forth on urgent matters.

- Dependency on third-party timelines: Since outsourced firms serve multiple clients, some scheduling limitations may apply, especially around busy periods like financial year-end or tax deadlines. That said, the best firms maintain strict service-level agreements to avoid disruption.

Side-by-Side Comparison: In-House vs. Outsourced Accounting

Let’s break it down.

| Feature | In-House Accounting | Outsourced Accounting |

| Costs | HighMonthly salaries, benefits, office space, software, and training | FlexibleMonthly packages, no overheads, often more affordable |

| Flexibility | LimitedHarder to scale quickly | HighScale up or down based on business needs |

| Compliance Support | Depends on internal expertise | Built-in—firms stay updated on corporate tax compliance in Dubai |

| Expertise Level | VariesDepends on who you hire | ConsistentAccess to seasoned professionals |

| Long-Term Scalability | Expensive as you grow | Designed to scale with your business |

If your business is looking for affordable accounting outsourcing in Dubai, especially in the face of growing regulatory demands, outsourced options give you the edge. But if you want full control and can afford the investment, an in-house setup might work.

Either way, you need to weigh what truly supports your growth, not just what looks good on paper.

Should You Hire an In-House Accountant or Outsource?

There’s no universal rule here.

A setup that’s perfect for a logistics firm might be completely wrong for a boutique consulting agency. You’ve got to assess your reality.

Here’s how to break it down:

- Your Business Size & Structure

If you’re a solo founder, a lean team, or an SME in early growth stages, outsourcing gives you access to professional-grade accounting without the commitment of building a full in-house team. But if you’re running a multi-departmental operation or expanding across regions, an internal finance team (or at least a hybrid model) might offer better integration with your business functions.

- The Nature of Your Transactions

The complexity of your financial activity should directly influence your accounting setup. If you’re dealing with high-volume sales, recurring subscriptions, or multi-currency transactions, you need systems and experts that can handle scale and nuance. That might mean custom software, advanced reconciliation, or tax advisory baked into your day-to-day operations—something not all outsourcing partners offer out of the box.

- Compliance Requirements

VAT filings, corporate tax returns, and audit readiness aren’t optional in the UAE. If your operations are already under regulatory scrutiny—such as in healthcare, fintech, or international trading—you’ll need a setup that can guarantee accuracy, thorough documentation, and timely submissions. Whether in-house or outsourced, this is where experience and UAE-specific compliance knowledge matter most.

- Budget & Long-Term Growth Plans

Initial costs can be misleading. Cheap solutions often fall short when your business scales. If you’re planning to enter new markets, raise funding, or prep for acquisition in the next few years, your accounting infrastructure needs to be able to grow with you. Consider not just cost but also flexibility, upgrade potential, and how much operational friction each model will create down the line.

Instead of picking what looks easiest today, ask yourself what’s most likely to support your business three years from now.

How Dubai Businesses Are Deciding in 2025

Here’s what’s actually happening on the ground this year:

- Startups and SMEs are leaning hard into outsourcing. These businesses don’t want the overhead of hiring and managing internal finance teams. Most are choosing monthly or quarterly packages from Dubai-based accounting firms that bundle bookkeeping, VAT filings, and tax compliance. It’s not just about saving money—it’s about speed, flexibility, and avoiding costly errors.

- Mid to Large-Sized Companies are creating hybrid structures. Instead of going fully in-house or fully outsourced, many are building internal teams for day-to-day financial operations while outsourcing technical or compliance-heavy tasks such as CT filing, audits, or cross-border tax advisory to specialised firms. This allows them to scale without overstretching.

- Top-Rated Accounting Companies in the UAE are adapting fast. It’s not just spreadsheets anymore. These firms now offer cloud-based dashboards, real-time reporting, bilingual client servicing, and deep expertise in UAE tax laws. Businesses choosing the best accounting firms in Dubai consistently mention one thing in reviews: they want proactivity, not just paperwork.

The smart money is going toward flexible, compliance-focused solutions. No one’s choosing based on tradition anymore; they’re picking what actually works.

Final Thoughts

Choosing between in-house and outsourced accounting isn’t about following a trend. It’s about what fits your business stage, your risk tolerance, and how fast you want to move.

If you’re unsure where to start, Emirates Company Setup offers more than just basic bookkeeping. Our financial services offer Dubai business accounting solutions that are scalable, affordable, and compliance-ready.

Whether you’re outsourcing monthly accounting or exploring business consulting accounting in Dubai, including CFO-level sessions and strategic finance insights, we help you stay financially sharp while focusing on growth.

Book a free consultation today and find out how we can simplify your numbers so you can focus on your growth.